Fica payroll tax calculator

Or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. Those are paid out of general tax.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

200000 per calendar year for single filers or.

. Both SECA and FICA tax rates have increased since they were introduced. There are 2 FICA taxes. Medicare tax rates rose from 035 in 1966 when they were first implemented to 135 in 1985.

Switch to hourly. Summarize deductions retirement savings required taxes and more. Determine the right amount to deduct from each employees paycheck.

How Contributions are Calculated. Taxable interest Tax Exempt interest. Your tax bracket doesnt necessarily affect how much money you contribute to FICA.

The tax rates vary based on income and can range from 0 all the way up to 37. When talking about payroll tax people are usually referring to FICA tax a set 765 and income taxes amount dependent on your tax bracket and W-4 filing. Divide the sum of all taxes by your gross pay.

How does your tax bracket impact how much FICA is withheld. Click here to read all you need to know about deducting the right amount of federal income taxes. The first is.

FICA and SECA taxes do not fund Supplemental Security Income SSI benefits. Self-employed people pay into Social Security and Medicare through a different tax called SECA Self-Employment Contributions Act and collected via their annual federal tax returns. Employers remit withholding tax on an employees behalf.

FICA Tax Rates. Federal Income TaxThe biggest tax of them all which can range from 0 all the way to 37. Determine if state income tax and local income tax apply.

See how FICA tax works in 2022. We wont go into all the. However youll pay an additional 09 of your salary toward Medicare if you earn over.

250000 per calendar year for joint filers. They pay both the employer and employee shares. FICA Part 2 Medicare Tax.

Yearly Federal Tax Calculator 202223. Check out our roundup of the Best Payroll Services for Small Business FICA tax and the self-employed. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

A bonus tax calculator or payroll software that calculates and remits payroll tax automatically can help. Deduct these withholdings in order to come up with taxable income. This tool allows people to not only calculate federal and all state.

FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings. FICA stands for Federal Insurance Contributions Act and it was first introduced all the way back in 1935. With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

Your Income in detail F1040 L7-21 Wages salaries tips etc. Payroll tax is an umbrella term typically used to refer to the main withholdings determined by your employer or the government. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

FICA Exempt Income Choose Type of Calculation. As mentioned above the tax rates for Medicare and Social Security in 2019 are 145 and 62 respectively. Pre-Tax WithholdingsSuch as 401k or FSA accounts that are exempt from payroll tax.

In addition to hours and pay rates you need to calculate and file FICA state and local taxes if applicable for you and your. Unfortunately payroll isnt that simple. For the past couple of decades however FICA tax rates have.

Paycheck City is a free online withholding calculator. Social Security tax rates remained under 3 for employees and employers until the end of 1959. FICA taxes using this years Medicare.

FICA Part 1 Social Security Tax. The FICA for Federal Insurance Contributions Act tax also known as Payroll Tax or Self-Employment Tax depending on your employment status is your contribution to Social Security and Medicare as a percentage of your salary. And the state tax rate for employee bonuses varies across the country so make sure to select your state from the calculators drop-down menu to calculate state tax withholding correctly.

2022 tax refund calculator with Federal tax medicare and social security tax allowances.

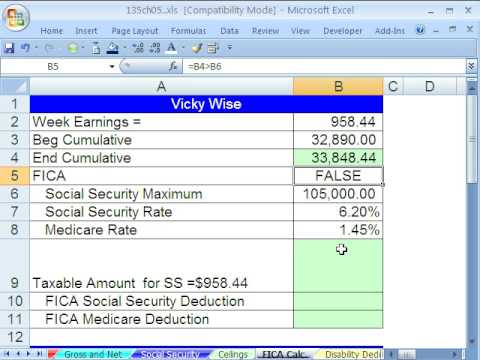

Excel Busn Math 41 Payroll Deductions With Ceilings Fica Youtube

What Is Fica Tax Contribution Rates Examples

Solved W2 Box 1 Not Calculating Correctly

Easiest 2021 Fica Tax Calculator

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax Calculator For Employers Gusto

How To Calculate Fica For 2022 Workest

Federal Income Tax Fit Payroll Tax Calculation Youtube

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Calculate Payroll Taxes Methods Examples More

Nvai7b73uqmw5m

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

Payroll Tax Vs Income Tax What S The Difference

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

Fica Tax What Is Fica Tax Rates Exemptions And Calculations