Growing perpetuity calculator

Present value of a growing perpetuity Expected cash flow in period 1 Expected rate of return Rate of growth of perpetuity payments To sum up to calculate the present. This perpetuity calculator shows you how to compute present value of perpetuity and perpetuity with growth.

How To Calculate Terminal Value Formula Calculator Updated 2022

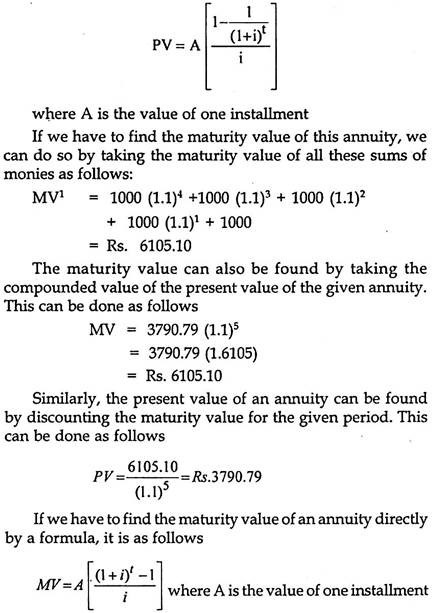

The present value of growing perpetuity is a way to get the current value of an infinite series of cash flows that grow at a proportionate rate.

. The current value of growing perpetuity is a bit difficult to calculate. A perpetuity in the financial system is a situation where a stream. First perpetuity is a type of payment which is both relentless and infinite such as.

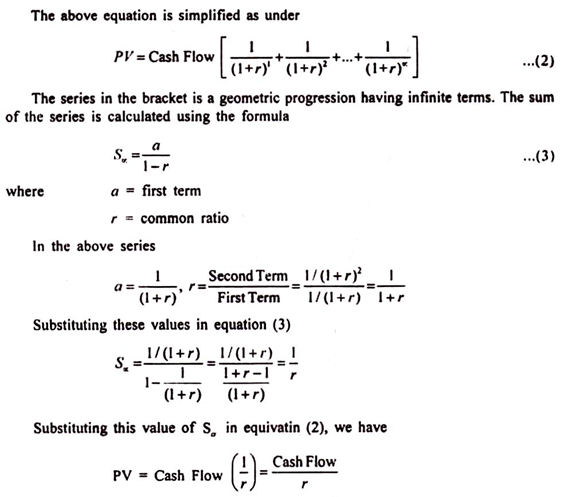

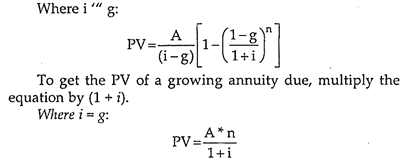

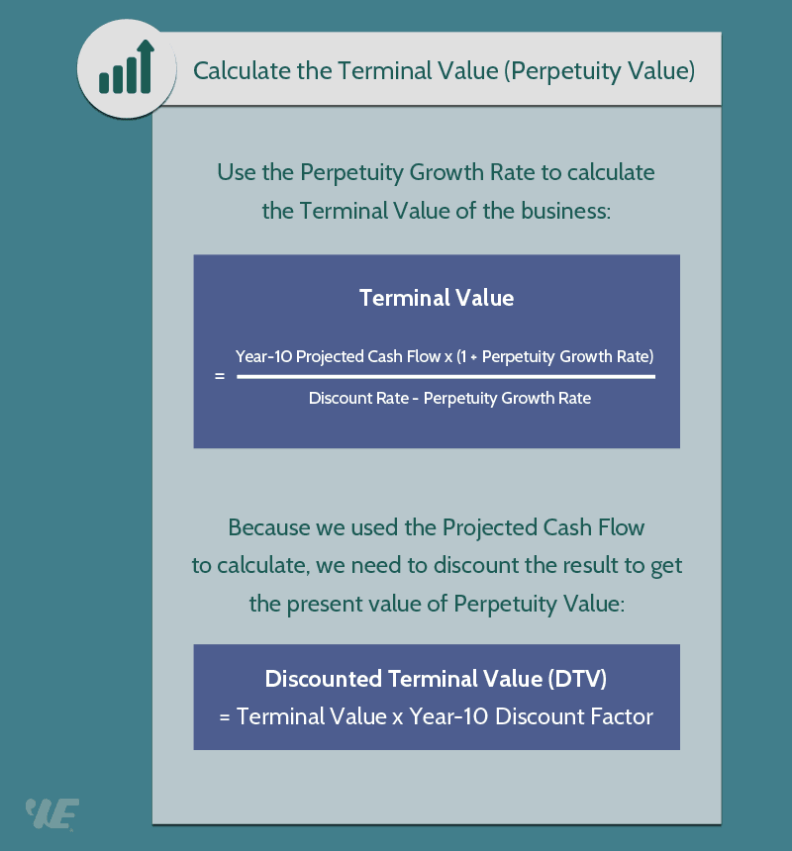

Growing Perpetuity Formula Present Value of a Growing Perpetuity Periodic Payment Required Rate of Return. The present value of a growing perpetuity formula is the cash flow after the first period divided by the difference between the discount rate and the growth rate. Present Value of Growing Perpetuity Calculator In stocks and bonds growing perpetuity can be explained as the series of payments at regular periods of time which grows gradually over the.

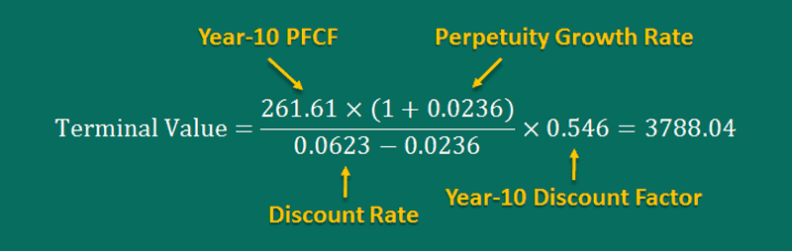

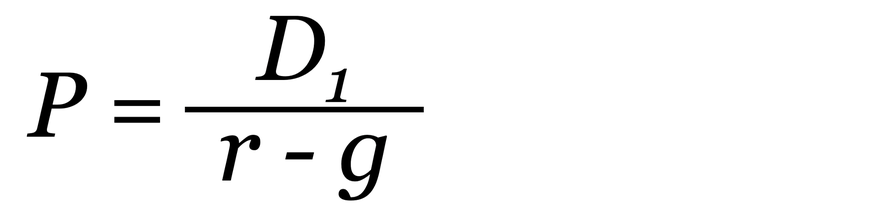

For a growing perpetuity the formula consists of dividing the cash flow amount expected to be received in the next year by the discount rate minus the constant growth rate. This online calculator will help you. Perpetuity Growth Method The most preferred method for calculating the terminal value is the perpetual growth method.

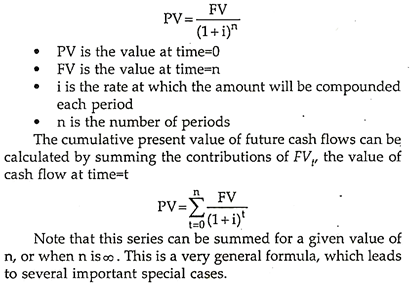

This is especially preferred by academics because theres a. PV Present Value P Payment r Discount Rate 100 g Payment Growth Rate 100 Adjust the discount rate to reflect the interval between payments which. The basic formula for growing perpetuity is as follow D Expected cash flow in period 1 R Expected rate of return.

Put simply it is the present value. PV P r - g Where. Computing the present value of a growing perpetuity is imperative because it paves way to value stocks and other investment opportunities available.

A growing perpetuity is a series. To calculate the terminal value using the perpetuity model in Excel create a table by inputting the values necessary for the equation into their own cell then plug the. This suite of perpetuity calculators allows you to calculate perpetuity to define the present value payment or annual interest rate.

Perpetuity is a series of never-ending payments. Lets take a look at how to calculate growing perpetuity. Our Perpetuity Calculator is developed with only one goal to help people avoid hiring accountants.

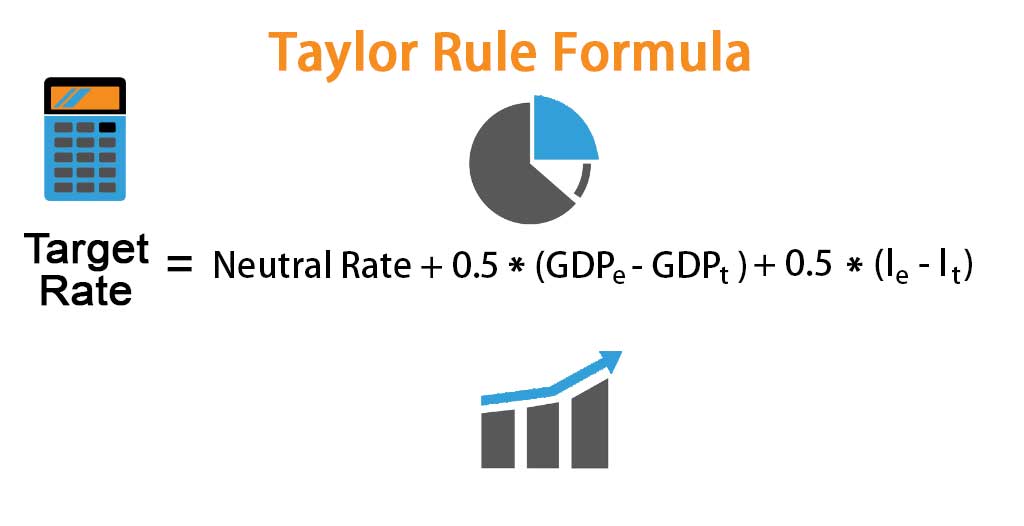

Taylor Rule Formula Calculator Example With Excel Template

Pyramid Chart Showcasing Different Tiers Of Content Investment Per Account For Account Based Marketing Strat Marketing Guide Technology Solutions State Of Play

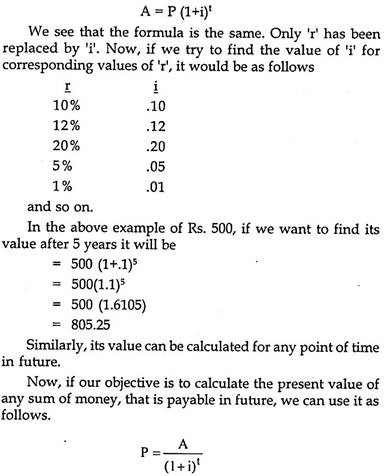

Time Value Of Money Meaning Importance Techniques Formula And Examples

Mid Year Convention Formula And Dcf Calculator

Time Value Of Money Meaning Importance Techniques Formula And Examples

Gordon Growth Model Definition Example Formula Pros Cons

How To Calculate Terminal Value Formula Calculator Updated 2022

10 Ba Ii Plus Calculator Compound Interest Present Value Future Value Youtube

2

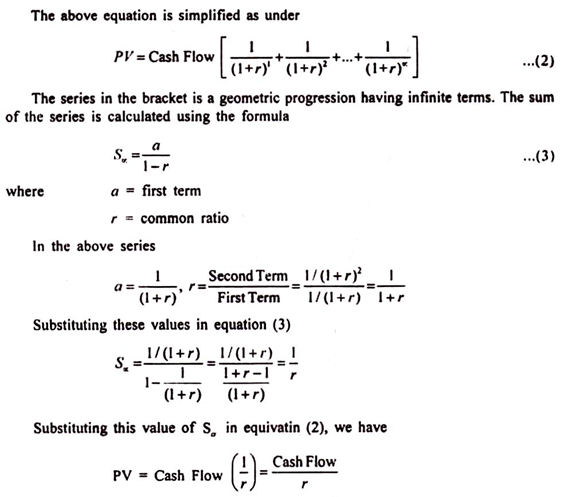

Present Value Of A Growing Annuity Formula With Calculator

Time Value Of Money Meaning Importance Techniques Formula And Examples

Time Value Of Money Meaning Importance Techniques Formula And Examples

Time Value Of Money Meaning Importance Techniques Formula And Examples

:max_bytes(150000):strip_icc():gifv()/presentvalue_final-25e185ad099a40ce817849fb2cec085e.jpg)

What Is Present Value Pv

Present Value Archives Double Entry Bookkeeping

Chapter Outline 4 1 The One Period Case 4 2 The Multiperiod Case Ppt Video Online Download

Special Education Caseload Binder Editable Special Education Caseload Binder Special Education Special Education Teacher Binder